Fun Tips About How To Improve Debtor Days

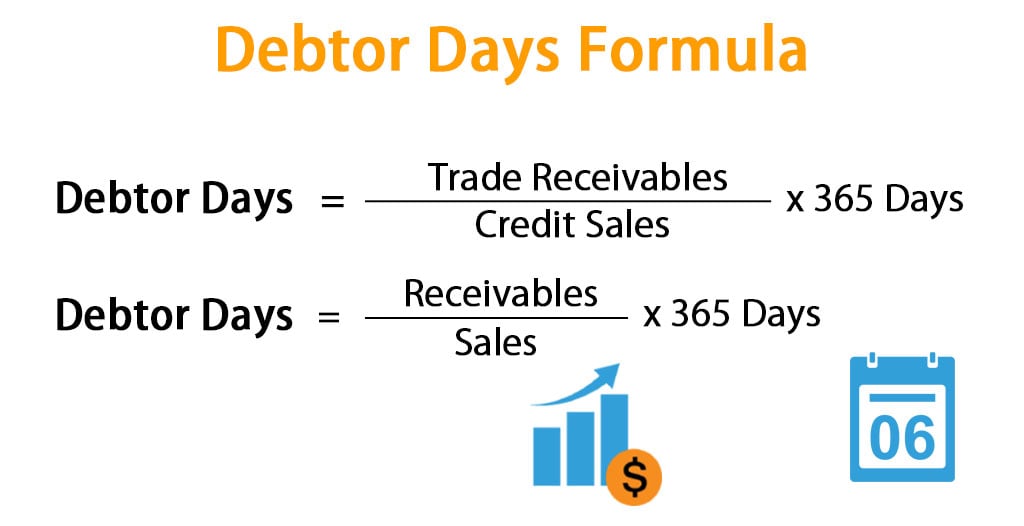

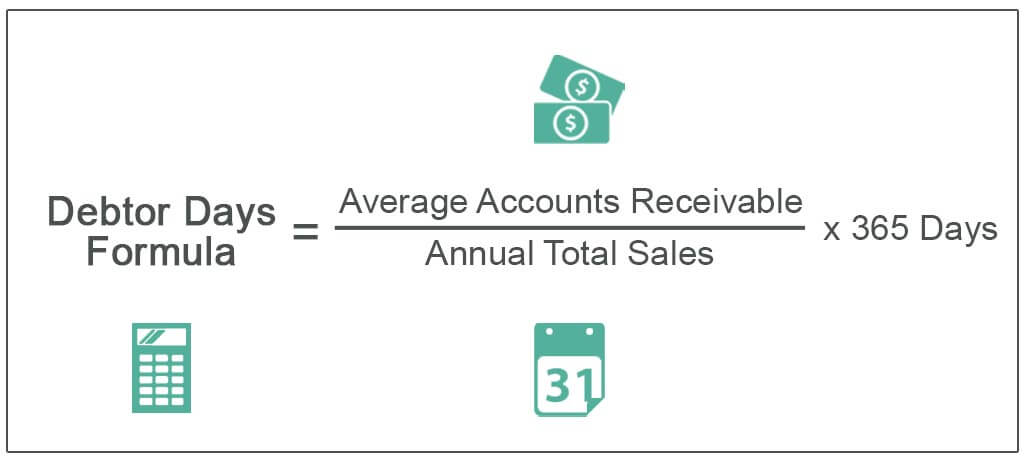

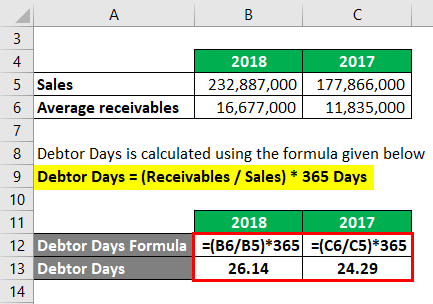

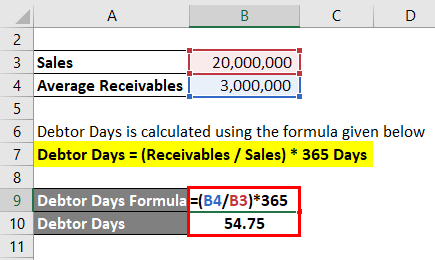

The formula is as follows:

How to improve debtor days. Firstly, determine the average accounts receivable of the company. Automation software, such as xero, is a great way to streamline the debtor management process. In the year end method, you can calculate debtor days for a financial year by dividing accounts receivable by the annual sales for 365 days.

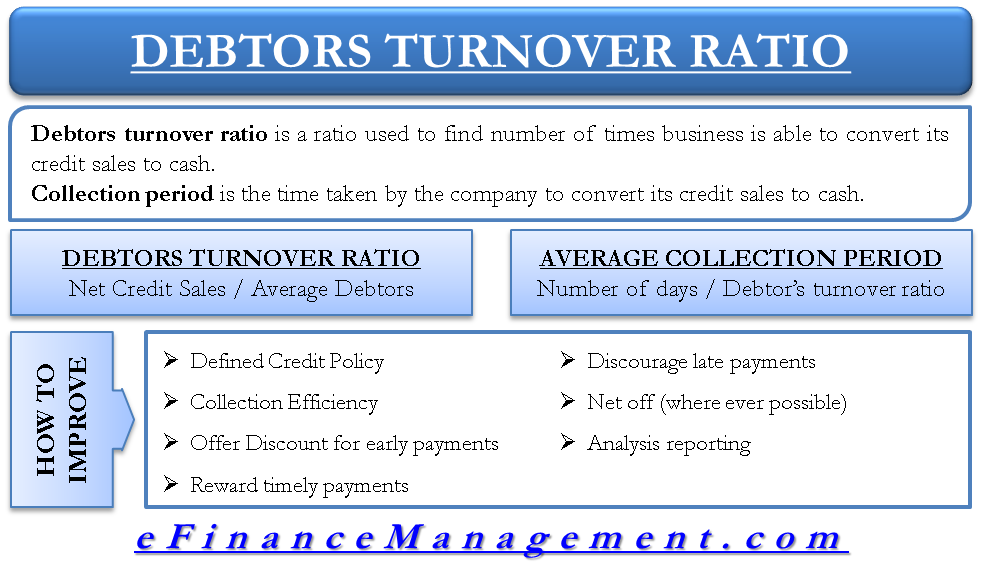

The invoices given to customers should be. How to improve (debtor’s) receivable turnover ratio / average collection period? Call us now on 020 3367 1106 for your initial complimentary consultation!

When creating an invoice, think about your messaging. The debtor days formula calculation is done by using the following steps: If your business is looking for ways to reduce the amount of time debt is owed, there are some straight forward actions you can take to mitigate this situation.

Negotiate payment terms with your suppliers. In times when winning new business is a challenge, we can. Here are a few tips to help you reduce your debtor’s days.

For example, if you use invoice finance in your business, you will often end up paying 3% for the first 40 days. The dso is a crucial number to monitor, because a small change in the figure can make a significant difference to your cash flow. Design and document clear credit policies and encourage adherence to.

6 ways to reduce your creditor / debtor days 1. Implement a strong set of. Initially, you choose your suppliers based on your specific need,.

%20(1).jpg)