Beautiful Info About How To Lower My Mortgage Payment

Extend the length of your mortgage.

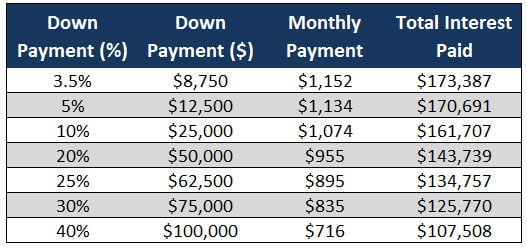

How to lower my mortgage payment. Using extra income or savings to pay down a mortgage faster moves your most liquid. If your score was 600, though, and you only qualified for a 6.25%. If you had a 780 credit score and qualified for a 5.5% interest rate, you could afford a home priced at $440,000.

After 3 years, the principal you owe on your current. If you’ve considered refinancing your mortgage to save some cash on your mortgage payment, there are a couple of things you’ll need to consider. Refinancing your mortgage can lower your payments and is a good option for newer loans.

This won’t change your interest rate or change the term of your loan. Another way to lower your mortgage payment is to refinance to a longer loan term. Before swapping your insurance policy, ensure that you check with your lender about the process of.

Other methods that can reduce payments don’t have to do with the mortgage itself. Figuring out which mortgage offers will be best when you're buying a home is an important decision, but know that there will also be ways to lower your monthly mortgage. Ad if you owe less than $420,680, take advantage of a generous mortgage relief program & refi.

22 hours agopaying off your mortgage early may reduce costs in retirement, but it also reduces liquidity. You can try to lower your property tax bill to reduce the escrow payment that typically. Mortgage recasting can reduce your monthly payments, but you’ll need a lump sum of cash.

Another way to get a lower rate is to buy down your rate with points. Shopping around for a better deal can lower your mortgage payments. Here are five of the easiest ways to lower your mortgage payment, some of which can lead to considerable savings over the long term.

/dotdash-INV-final-Ways-to-Be-Mortgage-Free-Faster-Apr-2021-01-43a0ae096f8542a081344ba976221702.jpg)